None of this was heard in court on July 2, 2018.

2010

September 27, 2010 Preforeclosure from Flagstar Bank Letters (First attempt at loan modification)

12/8/2010 Foreclosure attempt by Trustee Corps and Flagstar Bank

10/12/2010 Began working on loan modification after first foreclosure attempt by Trustee Corps and Flagstar Bank with a company.

Title : Mari

Posted on: 11-13-2010

Hi, a work out package was prepared and submitted to your lender. Since we need to wait for it to be scanned, imaged and able to be viewed in their system, I will call them late next week to confirm receipt. I will send you another update then. Thank you. Processing Dept.

———————————————————————————————

Title : Lisa

Posted on: 11-18-2010

Robert, I s/w Kisha in Loss Mitigation and she confirmed your file has been received and it is in line for review. Nothing is being requested at this time. Please let us know if you should receive any letters or calls from Flagstar in the meantime. next update will be by 12/3. Thanks, Lisa

———————————————————————————————

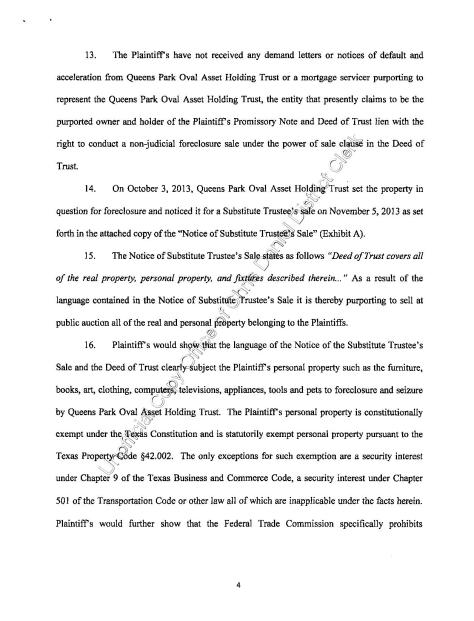

Title : Mari

Posted on: 12-03-2010

Hi, your file is in review. Nothing needed for now. Thank you. Processing Dept.

2011

PLease see the steps completed in your loan process below.

Completed Payment Schedule

Application Received

First Payment Received Due Date: 10/13/10 $ 750

Authorization Sent to Lender

Second Payment Received Due Date: 11/29/10 $ 600

Requested Docs From Borrower

Third Payment Received Due Date: 12/6/10 $ 600

Authorization Received by Lender

Fourth Payment Received Due Date: $

Docs Received from borrower

Paid In full

Package Sent to Lender

Lender Recieved Package Next follow up date:

Assigned to Negotiator

Comments

Title : welcome

Posted on: 10-12-2010

Hello and welcome! My name is Melissa. In order to process your submission, we are going to need Documents Required to Process Modification 1) Hardship Letter Must be hand signed and dated. 2) Proof of Income: -Pay stubs (2 months worth) Most recent, must be consecutive – Any Other Income (Social security, Disability, Child Support, Alimony, Rental Agreement(s) etc.) Must include all pages of court documents/agreements 3) W-2 for 2 years If you are an hourly W-2 employee and/or 1099 If you are a commissioned employee or receive Social Security, Disability, or Pension. 4) 2 years Completed Tax Returns All pages, must be hand signed and dated on pg. 2) 5) 4506-T Only needs to be signed and dated by you. This document is required by your lender to verify tax returns. 6)2 Months Bank Statements Most recent, must include name and all pages 7) Utility Bill Most recent, must include name and address 8) 1 Mortgage statement or Mortgage Coupon Most recent 9) Copy of Property Tax Bill & Proof of Insurance (If taxes and insurance are not escrowed) 10) Any Legal Notices from Lender (Foreclosure Docs, Notice of Intent, Demand Letter, etc.) our fax # is 561-300-2333 and I can be reached at 561-674-5150.Please remember that we will need you to send us your two most recent pay stubs and two most recent bank statements every 60 days This consistently allows us to update your lender as needed. Thank you. PLease add info@aemortgage.com to your email address book so our updates will not go to your spam folder. DOCUMENTS DUE IN 15 DAYS

———————————————————————————————

Title : m.s

Posted on: 10-12-2010

DOCUMENTS DUE IN 15 DAYS

———————————————————————————————

Title : m.s

Posted on: 10-18-2010

spoke at 832-651-8091 to confirm login information

———————————————————————————————

Title : angie

Posted on: 10-25-2010

spoke with and emailed I still need For Mr Douglas Additional pages of 08 1040 09 1099 (said was included but was not) Page 6 and 7 of September statement 1 more bank statement (must have name and be consecutive) Mr Turner 08 1040 09 w2 or 1099 2 months bank statement (most recent consecutive, must have name) Mr Ledoux No name on paystubs 09 1040 09 w2s or 1099 One more bank statement PLEASE SIGN PAGE 2 of 1040s PLEASE INCLUDE ALL PAGES OF 1040 AND BANK STATEMENTS

———————————————————————————————

Title : angie

Posted on: 10-26-2010

Received Jody w2

———————————————————————————————

Title : Angie

Posted on: 11-01-2010

Received package I am still missing Douglas 09 1099 for disability Turner 08 1040 Bank statements (did you see these statements?They are all encoded, except for an internet printout that does not have your name on it anywhere. You may need to get these printouts directly from the bank) Ledoux Proof of income must include name 09 w2 09 1040

Title : Angie

Posted on: 11-05-2010

I received awards letter and bank statements for douglas/turner

———————————————————————————————

Title : Angie

Posted on: 11-10-2010

Passing on to processor PER LISA

———————————————————————————————

Title : Lisa

Posted on: 11-12-2010

Your file has been assigned to Lead Processor, Mari Lopez, for final review and submission. Please look for further updates by next week. Thanks, Processing Dept

———————————————————————————————

Title : Mari

Posted on: 11-13-2010

Hi, a work out package was prepared and submitted to your lender. Since we need to wait for it to be scanned, imaged and able to be viewed in their system, I will call them late next week to confirm receipt. I will send you another update then. Thank you. Processing Dept.

———————————————————————————————

Title : Lisa

Posted on: 11-18-2010

Robert, I s/w Kisha in Loss Mitigation and she confirmed your file has been received and it is in line for review. Nothing is being requested at this time. Please let us know if you should receive any letters or calls from Flagstar in the meantime. next update will be by 12/3. Thanks, Lisa

———————————————————————————————

Title : Mari

Posted on: 12-03-2010

Hi, your file is in review. Nothing needed for now. Thank you. Processing Dept.

———————————————————————————————

Title : Mari

Posted on: 12-13-2010

Hi Robert, I did hear your v.m. I have not however, received your fax yet. You can fax it to 561-300-2333 or to 561-961-5528, Attn: Mari.. Thank you. Processing Dept.

———————————————————————————————

Title : Mari

Posted on: 12-13-2010

Received a fax from client Jody. It is from Trustee Corps.949-252-8300. I called and Spoke with Johnathan, he informed me that the letter meant that a foreclosure was filed by the lender ‘Flagstar’ and it will be recorded on 12/21/10. No sale date yet. Need to fax an ATR to 949-752-0320 Attn: Trish. Jody, no need to worry, we are working on a modification for you and we will follow up with the lender and attorney’s to make sure no sale date is put on your property and if a sale date is put on your property we will work on having it postponed, put on hold or cancel. Thank you. Processing Dept.

———————————————————————————————

Title : m.s

Posted on: 12-15-2010

left message at 832-651-8091 to confirm receipt of fax

———————————————————————————————

Title : Mari

Posted on: 12-21-2010

Working on file.

———————————————————————————————

Title : Mari

Posted on: 12-22-2010

Hi, your file continues to be in review with your lender. NO additional documents needed at this time. Thank you. Processing Dept.

———————————————————————————————

Title : Mari

Posted on: 01-03-2011

Hi, your lender is requesting updated income documents. If you have anything new for the unemployment and the awards letter or any pay-stubs please fax that to 561-300-2333 Attn:Mari. I will also need most recent bank statements (all pages). Processing Dept.

———————————————————————————————

Title : Lisa

Posted on: 01-24-2011

Mari has taken another position within the company so your file has been re-assigned to Lead Processor, Gina Peters. Further updates to follow later this week. Thanks, Lisa

———————————————————————————————

Title : Gina

Posted on: 01-31-2011

I spoke to your lender and they said that your loan is in active review. No additional documents are needed at this time.

———————————————————————————————

Title : Gina

Posted on: 02-15-2011

I spoke to your lender and they said that your loan is still in active review with no additional documents being requested as of yet.

———————————————————————————————

Title : Gina

Posted on: 03-02-2011

I spoke to your lender and they said that your loan is still in active review for a modification. They are not requesting any additional documents or information at this time.

———————————————————————————————

Title : Gina

Posted on: 03-04-2011

I called your lender and asked about the letter you received and they weren’t showing any record that they sent you a letter or were requesting anything. I will call them again next week.

———————————————————————————————

Title : Gina

Posted on: 03-11-2011

I called your lender and they couldn’t review your file because someone was in it working on it! At least they are working on it. I will call your lender again on Monday.

———————————————————————————————

Title : Gina

Posted on: 03-14-2011

I spoke to your lender and they are requesting some updated documents. Please fax me Robert’s updated pay stubs, updated stubs for Jody’s unemployment income, last 2 bank statements for all borrowers, 2010 W2s and 1099’s for all borrowers, and I need the most recent tax return for each borrower (I currently only have Jody’s 09 and Jere’s 08 tax return) If you have filed 2010 tax return please send me that, if you have not, then please send me your 2009 tax return and a letter that states you have not filed 2010 tax return. I also need the most recent property tax bill and homeowners insurance declaration page for the subject property. Your lender would like all borrowers to sign their financial form so I will email that to for all three of you to sign. Please fax it back to me with the other documents as soon as possible to 561-300-2333. Thank you, Gina Peter

———————————————————————————————

Title : Gina

Posted on: 03-21-2011

I have reviewed everything that has been sent so far and here is what I am still missing… Tax Return for Robert, one more pay stub for Robert (I only received 1, and I need 2), Jere and Jody’s 1099 for 2010 (I only received one 1099 and it was for Robert only), and I also need the document that I emailed you signed. Please send these items to me as soon as possible. Thank you, Gina Peters

———————————————————————————————

Title : Gina

Posted on: 03-23-2011

I received all of the documents your lender was requesting and I sent it all to them. I will call them in a few days to confirm that they have everything.

———————————————————————————————

Title : Gina

Posted on: 03-29-2011

I spoke to your lender and they said that they have all required documents and are reviewing everything. No additional documents are being requested at this time.

———————————————————————————————

Title : Gina

Posted on: 04-13-2011

I spoke to your lender and your loan is still in active review. They said that they are waiting on FHA approval, which means we should be almost finished! No additional documents are being requested at this time.

———————————————————————————————

Title : Processing – B

Posted on: 04-26-2011

Your file is in the final stages of review. You can expect a phone call from your lender within a few days or you may receive a packet in the mail. Please make sure to contact our office if and when this happens.

Thank You

———————————————————————————————

This was refused by Flagstar.

3/28/2011 Formal Complaint filed with HUD on foreclosure by Flagstar Bank.

5/10/2011 Formal complaint with Office of Thrift Supervision

5/24/2011 Attorney General of Texas Consumer Affairs Division of Consumer Affairs Complaint filed by Jere Douglas:

We have been attempting to negotiate a loan modification on our mortgage since September of 2010 with Flagstar. We have sent numerous documents to them every month and received false statements from them in return. This mortgage is in three names and I am a Disabled Marine Corps Veteran with Veterans Benefits from the Vietnam Era and other resources. I have a caregiver, Mr. Jody Turner that is also on the loan with me and is recognized by the Department of Veteran’s Affairs in such a capacity. I have been ignored by Flagstar as on the mortgage and various programs that are here in the United States and in Texas are not even able to be discussed about down payment assistance, loan modification are other asset protections for the Veteran or the Disabled. This household hit some hard times due to layoffs and jobloss but we are working on that and I am attempting to go back to work under the Ticket to Work Program of the Department of Social Security as I do not wish to stay on disability my entire life but prefer to be productive. Flagstar will not negotiate in any way and just gives the run around as you can see from the documents attached and other supporting time lines. In abject fear, we turned to a mortgage rescue company after threats from Flagstar on the phone about what will happen to us and our home. This company, American Executive Mortgage has promised something they cannot do, a reduction in payments and a loan modification. I have also filed an Equal Housing Opportunity Complaint through HUD simply because Flagstar tried to delve into the nature of my disability and I sincerely feel that might be a reason for this lack of action on their part. It really seems this subprime fixed rate mortgage was designed by Marquis Money Inc and Flagstar to be defaulted on and not sustainable. We did receive paperwork from Flagstar Bank on May 4th with a reinstatement agreement that is very vague and is not complete and has a clause in it that we cannot seek legal action at any time over this. It was to be signed and returned by May 12/13, however, the trustee in this foreclosure and the bank filed the Sheriff Sale on May 10, 2011 before this paper work and first payment was to be remitted which makes me question the validity of good faith in dealing with this thrift (flagstar bank) and if the mortgage has been packaged as a security and the bank even still owns it or not. I am at wits end here with this and am becoming ill from the stress of all this as a Disabled Marine Corps Veteran, Honorably Discharged in 1979 and my VA benefit for homeownership is not even able to be discussed with Flagstar. Thank You For Your Attention in this matter.

6/10/2011 Letter of Sheriffs Sale, unsigned, from Trustee Corps.

5/27/2011 5:26:47 PM

Today I have had three different people looking at our home for the Sheriff’s Auction on the 7th of June. Does this mean the Flagstar Attorney cannot keep her word on this verbal agreement?

It is in the records at the HUD office here in Houston about the negations with the outside counsel of Flagstar on the mortgage modification with Ms. Thomas.

In a search of Houston, Harris County records and the HUD website, there is no foreclosure sale on this property as of today. I really question what is going on at this point in time.

5/31/2011 12:05:41 PM

More run around with Flagstar, communication has ceased with the thrift itself and is through HUD and the outside counsul which I do not even know their name.

6/2/2011 10:36:24 AM

Today am awaiting contact with HUD Ada Raglin Thomas and the Flagstar Attorney. Jody has advised me to let it be known of all the programs we qualify for and to push that out there.

6/13/2011 2:39:45 PM

I just received a call from HUD, Catherine at 405-609-8400 concerning dealings with flagstar and the supposed Trial Period that was sent to us on May 2, 2011. I asked her not to get involved and now she is calling the mortgage company to resend the agreement. I tried to tell her that it was already in negotiation through Ms. Thomas here in Houston and HUD through their outside counsul, but she refused to listen and is just causing unnecessary waves at the present time. . Communication within HUD would be nice where the right hand knows what the left hand is doing.

Additional info for 12618 Ashford Pine Dr, Houston, TX 77082

Sales History

Date Amount Price/SF

4/15/2008 $138,287 $55.01

Sign Up Now to view more info.

On http://www.realtytrac.com it shows our house has already been sold on 4/15, 2011. What’s going on with this?

http://www.realtytrac.com/property/TX/Houston/77082/12618%20Ashford%20Pine%20Dr/geo/29.729881,-95.611694

6/11/2011 response through the office of Senator Kay Bailey Hutchinson from Flagstar Bank

6/20/2011 Trustee Corps Foreclosure Sheriffs Sale Letter

5/31/2011 12:05:41 PM

More run around with Flagstar, communication has ceased with the thrift itself and is through HUD and the outside consul which I do not even know their name. We are to go through Ms. Thomas and the Flagstar Attorney to negotiate this modification and that is what we are trying to do.

6/2/2011 10:36:24 AM

Today am awaiting contact with HUD Ada Raglin Thomas and the Flagstar Attorney. Jody has advised me to let it be known of all the programs we qualify for and to push that out there. Received word from that the sale is cancelled and to negotiate through her with Flagstar.

6/13/2011 2:39:45 PM

I just received a call from HUD, Catherine at 405-609-8400 concerning dealings with flagstar and the supposed Trial Period that was sent to us on May 2, 2011. I asked her not to get involved and now she is calling the mortgage company to resend the agreement. I tried to tell her that it was already in negotiation through Ms. Thomas here in Houston and HUD through their outside counsul, but she refused to listen and is just causing unnecessary waves at the present time. . Communication within HUD would be nice where the right hand knows what the left hand is doing.

6/15/2011 10:56:22 PM

Alan and Jody have just received a letter from Keeling law Firm in Houston, Texas with notice of Trustee Foreclosure Auction of 12618 Ashford Pine Drive, Houston, Texas 77082 for July 5, 2011. We have not received anything from the Sheriff’s Department or the Trustee Company or Flagstar Bank about this new sale date, only from Keeling Law Firm. I am really concerned about what is going on with this right now. Please see attached. I do know this process is under review by the Office of Thrift Supervision and sincerely feel this is nothing short of harassment at the present time. We have been going through this process since September of 2010. I feel I have been mislead by HUD and the Attorney of Record for Flagstar Bank on negotiations to modify the loan on this property at this time. I have not received anything from Marquis Money about this process either. Marquis Money seems to be a shadow company owned by Jeremy Raddack along with Raddack and Associates Law Firm (County Commissioner Steve Radack’s son) here in Houston Texas. The office listed is empty and there is no contact information for Marquis Money through phone or e-mail and we have not received the last notice from the trust company or flagstar bank.

“We Cut the Time it Takes to Solve Default Problems”

Welcome to Trustee Corps

Foreclosure Bankruptcy Loss Mitigation Default Actions

Our Clients Include

Loan Service Companies, Mortgage Companies, Banks,

Attorneys, Government Agencies, Saving Banks,

Freddie Mac, Fannie Mae, Pension Funds,

Credit Unions, Finance Companies,

Escrow & Title Companies, HOA’s

Private Investors

Processing Foreclosure and Default Action

in the states of

California, Arizona ,Nevada, Washington,

Idaho, Montana, Texas, Hawaii, Utah, Alaska and Oregon

http://www.trusteecorps.com/home.htm

http://condobiz.com/SoCal/collections.htm

http://www.city-data.com/businesses/526687785-mtc-financial-inc-irvine-ca.html

Mtc Financial Inc in Irvine, CA is a private company categorized under Foreclosure Assistance. Current estimates show this company has an annual revenue of $500,000 to $1 million and employs a staff of approximately 1 to 4.

There are way too many companies involved in purchasing a home now.

8/01/2011 Loan Modification Agreement per discrimination complaint with HUD Title VIII #06-11-0366-8 Flagstar is the current holder and servicer of the FHA loan.

Modification Effective Date: New Unpaid Principal Balance: New Principal & Interest Payment: Escrow Payment:

New Monthly Payment: New Interest Rate:

Remaining Mortgage Term: Maturity Date:

First Modified Payment Due: Last Modification Payment: Cash Contribution at Closing: New Payment Address:

08/01/2011

$125,781.95

$380.90 $619,10 $1,000.00

2.00% fixed for 480 months

480 months

8/1/2051 9/1/2011 8/1/2051 $1,000.00 Flagstar Bank

ATTN: Payment Processing S-142-3 5151 Corporate Dr.

Troy, MI 48098

Borrowers, for themselves and each of their successors, assigns, agents, attorneys, heirs, relatives, executors, administrators, and representatives, releases and discharges Flagstar and each of its past and present officers, partners, members, shareholders, employees, agents, directors, predecessors, affiliates, parents, subsidiaries, attorneys, trustees, insurers, transferees, and representatives from any and all claims and causes of action which Borrowers has or may

LeDoux-Turner-Douglas 502026785 Settlement Agreement – Page 1

provided that Flagstar receives the cash contribution at closing in the amount of One Thousand Dollars and no/100 ($1,000.00) in certified funds or ta’T6 cashier’s check made payable to Flagstar Bank, FSB, together with executed copies of this Agreement and the Modification Agreement, on or before September 15, 2011.

After this is where we first hired John with lawsuit number 1. 2011

Paid 5000.00 on the front end and 2500 on the back end.

5/27/2011 5:26:47 PM

Today I have had three different people looking at our home for the Sheriff’s Auction on the 7th of June. Does this mean the Flagstar Attorney cannot keep her word on this verbal agreement?

It is in the records at the HUD office here in Houston about the negations with the outside counsel of Flagstar on the mortgage modification with Ms. Thomas.

In a search of Houston, Harris County records and the HUD website, there is no foreclosure sale on this property as of today. I really question what is going on at this point in time.

5/31/2011 12:05:41 PM

More run around with Flagstar, communication has ceased with the thrift itself and is through HUD and the outside counsul which I do not even know their name. We are to go through Ms. Thomas and the Flagstar Attorney to negotiate this modification and that is what we are trying to do.

6/2/2011 10:36:24 AM

Today am awaiting contact with HUD Ada Raglin Thomas and the Flagstar Attorney. Jody has advised me to let it be known of all the programs we qualify for and to push that out there. Received word from that the sale is cancelled and to negotiate through her with Flagstar.

6/13/2011 2:39:45 PM

I just received a call from HUD, Catherine at 405-609-8400 concerning dealings with flagstar and the supposed Trial Period that was sent to us on May 2, 2011. I asked her not to get involved and now she is calling the mortgage company to resend the agreement. I tried to tell her that it was already in negotiation through Ms. Thomas here in Houston and HUD through their outside counsul, but she refused to listen and is just causing unnecessary waves at the present time. . Communication within HUD would be nice where the right hand knows what the left hand is doing.

6/15/2011 10:56:22 PM

Alan and Jody have just received a letter from Keeling law Firm in Houston, Texas with notice of Trustee Foreclosure Auction of 12618 Ashford Pine Drive, Houston, Texas 77082 for July 5, 2011. We have not received anything from the Sheriff’s Department or the Trustee Company or Flagstar Bank about this new sale date, only from Keeling Law Firm. I am really concerned about what is going on with this right now. Please see attached. I do know this process is under review by the Office of Thrift Supervision and sincerely feel this is nothing short of harassment at the present time. We have been going through this process since September of 2010.

Something happened that we knew nothing about from John and foreclosure began again with transfer to Roundpoint. Flagstar was in the first lawsuit as a defendant.

“The Complaint also alleges that FLAGSTAR’s DE underwriters repeatedly endorsed loans for FHA insurance that did not comply with HUD’s underwriting requirements and thus were not eligible for government insurance. FLAGSTAR’s DE underwriters nevertheless falsely certified to HUD, for each loan they endorsed for FHA insurance, that it was eligible for such insurance.”

And yet this Mortgage Servicer is still allowed to do business in the same ways along with their cohorts in crime. Where is the justice and how can this be fixed? We have had problems with the mortgage on this property since day one, trying to make payments, getting payments in on time and then the payment’s showing as late with extra charges thrown on the next month. There is no payment book and there is no tracking of payments with scam artists like this. It seems this is what the financial institutions in the United States have become, scam artists with Government support.

http://www.hudoig.gov/reports-publications/audit-reports/final-civil-action-flagstar-bank-fsb-settled-false-claims-act

Flagstar did not conduct its operations in the underwriting of

FHA loans in accordance with HUD-FHA regulations.

On February 24, 2012, Flagstar admitted, acknowledged, and accepted responsibility for submitting false certifications to HUD about the eligibility of its loans for FHA insurance.

In a settlement reached with the U.S Attorney’s Office, the lender

agreed to pay $132.8 million to the United States in damages and penalties under the False Claims Act and to reform its business practices.

Flagstar admitted that during the period January 1, 2002, to February 24, 2012, it delegated underwriting decisions to unauthorized staff.

The lender also admitted that it underwrote and approved for FHA insurance loans that did not comply with certain HUD-FHA underwriting requirements, and HUD paid insurance claims on these ineligible loans.

Further, the U.S. Attorney’s Office announced that Flagstar set daily quotas for its HUD approved underwriters and underwriting assistants and paid these employees substantial incentive awards for exceeding daily quotas.

Flagstar agreed to pay $132.8 million and to other concessions to resolve the U.S. Government’s claims.

The lender agreed to pay $15 million within 30 days after approval of the settlement by the court and make additional payments totaling $117.8 million as soon as it met certain financial benchmarks.

Additionally, Flagstar agreed to

(1) comply with all relevant HUD-FHA rules applicable to direct endorsement lenders,

(2) the completion of a 1-year period in which Flagstar’s compliance with HUD-FHA rules would be monitored by a third party at Flagstar’s

expense, and

(3) implementation of a training program for all employees involved in the origination and underwriting of FHA loans. Flagstar also agreed to certify to HUD that the individuals in senior leadership positions who previously had primary responsibility for initiating and overseeing Flagstar’s manual underwriting process were no longer employed by

the lender

. Predatory Lending and Mortgage Fraud

On February 24, 2012, the U.S. Department of Justice (“DOJ”) filed a complaint in the United States District Court for the Southern District of New York, Case No. 12-cv-01392, against the Company alleging that for over a decade Flagstar had been improperly approving thousands of residential home mortgage loans for government insurance. Specifically, the DOJ alleges that the Company: used unauthorized staff employees in the loan approval process; paid substantial incentive awards to these unauthorized employees for exceeding certain quotas; permitted underwriters to submit false certifications to the Federal Housing Administration (“FHA”) and the U.S. Department of Housing and Urban Development (“HUD”); and misled FHA and HUD by certifying that the loans had been fully underwritten by properly registered and sufficiently experienced underwriters when they had not. The DOJ further alleges that as a result of the foregoing, thousands of loans were approved for government insurance that did not qualify for insurance and when the loans defaulted, HUD was forced to cover the losses.

On March 13,2012 it was announced that shareholder rights firm Robbins Umeda LLP was investigating possible breaches of fiduciary duty and other violations of the law by certain officers and directors at Flagstar Bancorp, Inc.

In particular the firm investigated allegations that Flagstar violated the False Claims Act when it improperly endorsed federally insured mortgage loans that eventually defaulted and falsely certified its loan underwriting practices to federal housing authorities. On February 24, 2012, the U.S. Department of Justice filed a complaint against Flagstar, which alleges that Flagstar utilized under-qualified underwriting assistants to approve thousands of residential home mortgage loans for Federal Housing Administration insurance. The complaint also alleges that Flagstar improperly set daily quotas for the underwriting assistants and paid them substantial incentive awards for exceeding their quotas. While engaging in this scheme, the officers and directors of the company not only exposed Flagstar to significant liability, but represented to the investing public that Flagstar was operating in compliance with all applicable laws and regulations.

2013

July 11,2013

Transferred to Roundpoint for mortgage servicing

Asked John what happened and he handed the case to his partner William in his office and the new lawsuit began.

Initial payment of 5000.00

There are no invoices from these attorneys.

RoundPoint Mortgage services hundreds of DASP mortgages in Philadelphia through shell companies with names like Newlands Asset Holding Trust or Queens Park Oval Asset Trust, all based out of the same anonymous North Carolina office building.

The reported no payments were court ordered as the foreclosure process was illegal and invalidated the Promissory Note and Deed of Trust is inaccurate because the court ruled in our favor declaring the actions as illegal and thus voiding the lien. I am requesting that the item be removed from my credit report or updated to show paid in full to correct the information.

Another part of the case involved the Mortgage Broker that was illegally brokering Mortgages without a license in the State of Texas through Keller Williams Realty. The mortgage began in April of 2008 and involved two lawsuits before final judgment was passed against Queens Park Oval Assets in Dallas, Texas and their leaning to Accelerate the loan and all our possessions which is illegal in the State of Texas. Roundpoint Mortgage Servicers is the company, along with Trustee Corps that put the pressure on us and refused to speak with me, the third person on the mortgage simply because it didn’t fit their paperwork system.

I have challenged this through the credit bureaus three times now and RoundPoint refuses to close this and wipe the slate clean.

This is doing irreparable harm to me as a disabled veteran health wise and financially.

It is my belief that Flagstar Bank acted in conjunction with Marquis Money (an unlicensed mortgage broker in Texas) to create the fraudulent mortgage insured under the FHA program. Also, we have not signed nor negotiated a Conventional Mortgage so that does not exist as is listed on the Credit Report as a Conventional Mortgage. We were also not told that FHA had paid the mortgage off after our 5 attempts for a loan modification with Flagstar Bank and the supposed loan was transferred to Roundpoint Mortgage. Flagstar dual tracked the modification and foreclosure from 2010 to 2013. I do believe Flagstar and Marquis Money along with Trustee Corps and Queens Park Oval Assets (Malcolm Cisneros) conspired to create the mortgage to defraud the Government and us. I am now a creditor holding Flagstar accountable for the damages we endured through 5 attempts at a mortgage modification where they lost paperwork and treated us badly.

Consumers need to know that they may be dealing with companies who are unlicensed and are not authorized to act as a mortgage lender or mortgage broker. In addition, it is also an unfair and deceptive act for a licensed mortgage lender or mortgage broker to conduct business with a person or company which is not licensed.

Consumers who encounter problems during the mortgage process can call the Division of Banks for assistance. Anyone wishing to verify the licensing status of a mortgage lender or mortgage broker can call the Division of Banks’ Consumer Hotline at (800) 495-BANK (2265) extension 1501. Consumers can also inquire as to whether there are any complaints outstanding against a licensed mortgage lender or mortgage broker.

All we wanted was a mortgage modification and this began in December of 2008